Introduction to the KDJ 指标 thinkorswim

Are you ready to elevate your trading game? The KDJ 指标 thinkorswim might be the tool you’ve been searching for.

As a trader, having access to reliable indicators is crucial for making informed decisions.

Among them, the KDJ 指标 thinkorswim stands out with its unique blend of momentum and trend analysis.

This powerful tool can help identify potential buy and sell signals, enhancing your market strategies on Thinkorswim.

Whether you’re a seasoned trader or just starting out, learning how to effectively use the KDJ 指标 thinkorswim can significantly impact your trading results.

In this guide, we’ll walk you through everything you need to know about the KDJ 指标 thinkorswim in —its components, setup process, interpretation of signals, tips for success, and common pitfalls to avoid. Let’s dive in!

Understanding the Components of the KDJ 指标 thinkorswim

The KDJ 指标 thinkorswim combines three key components: the stochastic oscillator, a signal line, and a divergence analysis.

At its core, the stochastic oscillator measures momentum by comparing an asset’s closing price to its price range over a specific period. This gives traders insight into whether an asset is overbought or oversold.

Next is the signal line, which smooths out volatility in the data. By providing clearer directional cues, it helps traders identify potential entry and exit points more effectively.

Divergence analysis examines discrepancies between price action and KDJ 指标 thinkorswim. Such divergences can indicate impending reversals or continuations in market trends.

Together, these elements create a powerful tool for market analysis. Understanding how they interact enhances your ability to make informed trading decisions using Thinkorswim’s platform.

How to Set Up and Apply the KDJ 指标 thinkorswim

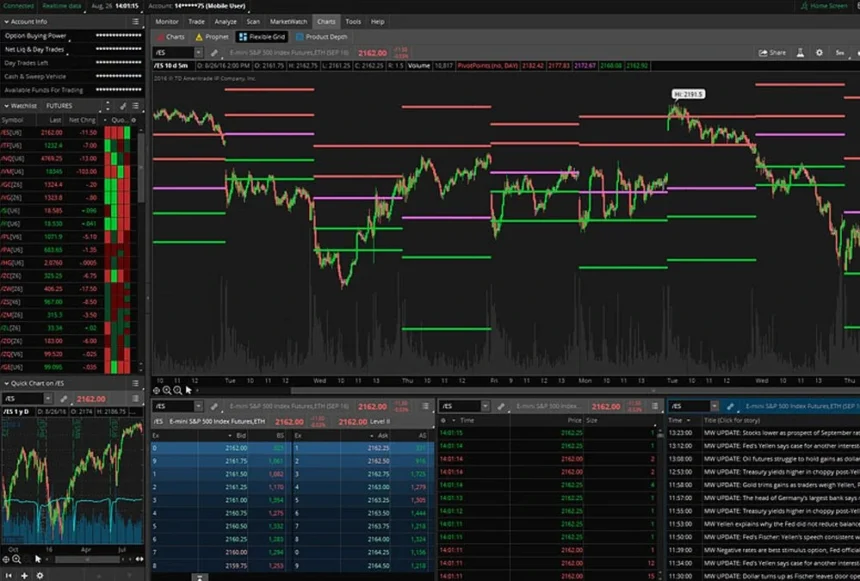

Setting up the KDJ 指标 thinkorswim is straightforward. Start by launching your Thinkorswim platform and navigating to the chart where you want to apply this tool.

Next, click on “Studies” at the top of your screen and select “Edit Studies.” A new window will pop up. Here, type “KDJ 指标 thinkorswim in the search bar to quickly locate it.

Once you’ve found it, double-click the indicator or hit “Add selected.” You can customize settings such as length and smoothing according to your trading strategy. Adjusting these parameters allows for a more tailored analysis suited to your preferences.

After applying the KDJ indicator, observe how it integrates into your chart. Make sure it’s visible alongside other indicators or price action elements that you typically use during trades. This setup helps provide clarity when interpreting signals later on.

Interpreting and Using Signals from the KDJ 指标 thinkorswim

The KDJ indicator provides distinct signals that traders can utilize for making informed decisions. A key aspect to watch is the crossover of the K line and D line. When the K line crosses above the D line, it often suggests a bullish signal, indicating potential upward momentum.

Conversely, when the K line dips below the D line, it may indicate bearish sentiment. This could hint at an impending decline in price.

Additionally, pay attention to overbought and oversold levels indicated by values above 80 or below 20. These extremes suggest potential reversals where prices might change direction.

Using these signals effectively requires patience and practice. It’s essential to combine them with other analysis tools for confirmation before entering trades. Adapting your strategy based on market conditions will enhance your trading precision while using this powerful indicator.

Tips for Maximizing the Effectiveness of the KDJ 指标 thinkorswim

To get the most out of the KDJ 指标 thinkorswim, consider combining it with other technical analysis tools. Pairing it with moving averages or support and resistance levels can provide a clearer picture of market trends.

Adjust your settings based on your trading style. Experiment with different timeframes to see what works best for you. Short-term traders might benefit from smaller intervals, while long-term investors may prefer daily charts.

Keep an eye on volume as well. High trading volumes during signal occurrences can confirm the strength of KDJ 指标 thinkorswim signals, making them more reliable.

Stay disciplined in following your strategy. Don’t let emotions drive decisions when using the KDJ 指标 thinkorswim; stick to your plan for consistent results over time.

Common Mistakes to Avoid When Using the KDJ 指标 thinkorswim

One common mistake traders make with the KDJ indicator is relying solely on it without considering other market factors. Market conditions can shift rapidly, and ignoring them could lead to misinterpretation of signals.

Another pitfall is overtrading based on short-term movements. The KDJ may generate frequent signals, but acting on every one can quickly deplete your resources and increase risk exposure.

Failing to adjust settings according to specific trading strategies is also an error. Each trader’s approach differs; what works for one might not suit another. Customizing the KDJ’s parameters can yield more relevant insights.

Many overlook the importance of backtesting their strategy using historical data. Without validation through past performance, reliance on current indicators could be misleading or detrimental in live trading scenarios.

Conclusion

The KDJ 指标 thinkorswim is a powerful tool for traders using Thinkorswim. By understanding its components and how to interpret the signals it generates, you can enhance your trading strategy significantly. Setting up the KDJ indicator on Thinkorswim is straightforward, making it accessible even for beginners.

It’s crucial to use this tool effectively by recognizing its strengths and limitations. Implementing tips like combining it with other indicators can further improve your trading decisions. Avoid common mistakes such as over-relying on the KDJ 指标 thinkorswim or ignoring market conditions; these pitfalls can lead to missed opportunities or losses.

By incorporating the KDJ 指标 thinkorswim into your trading arsenal thoughtfully, you stand a better chance of navigating the markets successfully and achieving your financial goals.